The PKU MBA Speaker Series was proud to host Professor Paul Gillis, the Co-Director of the Peking University, Guanghua School of Management MBA program and renowned accounting expert for an evening of business-insight and fascinating stories relating to Activist Short Selling in China entitled вҖңPaul GillisвҖҷ Activist Short Selling 101вҖқ.

On Thursday, November 5th, drawn by the most recent edition of the PKU MBA Speaker Series, an excitable crowd braved an unexpected snowfall to gather in the heart of BeijingвҖҷs central Gulou area. Those in attendance drew from a variety of backgrounds; there were students, alumni, professionals, a journalist or two and even a couple passersby who decided to take part in the occasion. The event also attracted the Associate Dean of Peking University, Guanghua School of Management, the Director of the MBA program and an accounting expert in his own right, Professor WU Liansheng.

Speaking to a near-capacity David Choice CafГ© & Bar, Professor Gillis briefly introduced the concept of Activist Short Selling before drawing from his personal experience to regale the audience with legendary cases and other notable stories. Truthfully, activist short selling is probably not a topic intimately familiar to most people. Yet, according to Professor Gillis, it is a vital one in understanding the Chinese business landscape.

As Professor Gillis explained, activist short sellers are those investors who sell unowned or borrowed shares hoping to repurchase them later at a lower price. However, as trying to time the market is rarely wise, they take it upon themselves to ensure a positive return. Activist short sellers target companies who they believe may be perpetrating fraud by borrowing shares of said company, before making accusations and releasing condemning reports. As the companyвҖҷs shares fall, so does the activist short sellersвҖҷ profits rise.

Professor Gillis made clear why it is important to understand the dynamics of these transactions as, over the past several months, international eyes turned to ChinaвҖҷs stock market as seemingly unpredictable drops and gains shook balance sheets around the world. Indeed, prior to these instabilities, activist short sellers had long been stirring the pot. And so, many analysts and traders blamed activist short sellers for the struggles of the Chinese stock market. While Professor Gillis feels that this blame is misplaced and that the marketвҖҷs behavior was simple correction, China issued a set of new rules in August aimed at discouraging all forms of short selling in an effort to curb volatility in its stock market.

The enlightening talk lasted approximately 45 minutes and was followed by an engaging round of Q&A. Here, attendees discovered that wrongfully accused companies donвҖҷt have much recourse against their accusers, especially in the United States due to the 1st amendment. Attendees also learnt that Chinese companies were historically easy targets as they operated in a regulatory system that offered little to no protection. Interestingly, professor Gillis also revealed that no state owned enterprise has ever been targeted by activist short sellers.

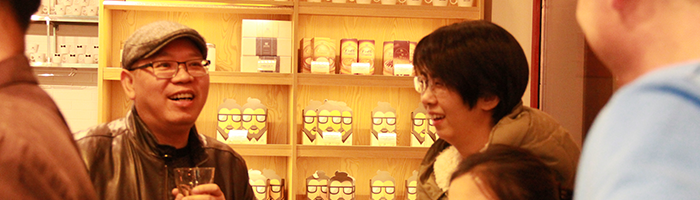

Afterwards, attendees were afforded the opportunity to mingle with one another and Professor Gillis over some complimentary beer and wine. As a whole, the event was a resounding success offering unusual insight into a unique aspect of doing business in China.