10��21���������ΰ�ײ���ΰ�ײ�ͷ�������½����о�ϵ�б���ĵ�ʮһ�ݱ�����ʽ����������������۽����й���ļREITs�Ե�ĸܸ��������о�������

ժҪ�������Ž�ȫ��REITs����Դ�ṹ������ʵ������������ҹ���������ļ������ʩ֤ȯͶ�ʻ���ָ�������У����еĸܸ������������������������������ȫ��ʵ���������������REITs�ܸ�����������������г�����������ģʽ�������������������������������ڻ�����ʩREITs�Ե���������������ܸ����ȵ��趨��Ҫ˼���г��������Ͷ���߲����졢REITs��Ӫ�������б���Ʒ��Σ���Լ�����ϵͳ�IJ�Э���������������������������������������ĸܸ���Լ�����к�������������Ӻ���������������Ҫ�������ҹ���ļREITs�г�������Ϊ���ʵ����ڼ��г���������ܸ����ȵ��趨����Ҫ˼��Ʒ��Σ���ķ������������Ҫ˼���к�REITs��ֵ�������г����������Ӧ������REITsծ�ߺ�Ƿծ�����Ķ�Ԫ������������Ƿծ���ڹ���������������г��Ľ�һ�����ƺ������ҹ���ļREITs�ܸ���Լ���������ϵ���Ŀռ�����

��Դ�ṹ�������ָ��ҵ������Դ����ծ����Դ����Ȩ��Դ���ļ�ֵ��ɼ��������ϵ��������ǹ�˾��������Ľ������������ʲ�Ƿծ�ʣ�Ҳ�Ƹܸ��ʣ��Ƿ�Ӧ��Դ�ṹ�Ľ���ָ��������������ѧ��Myers��1984����������Э�ᣨAmerican Finance Association������ϯ�����н�����Ϊ����Դ�ṹ֮�ա��Ľ������������Modigliani and Miller(1958)�����ġ���Դ�ṹ���ۡ����������˼���⡪������ҵ��ʵӦ������ѡ��ܸ����������������������Դ�ṹ��Ϊ��������Դ�ṹ���ۡ��롰�����������ۡ�����˼������������ʹ��Դ�����Ϊ��˾��������ʵ����ѧ�����ձ����۵Ļ�������������ҵ�������������������Դ�ṹ���н�����ҵ�ʽ�Ǯ����ֹ��ҵΣ��������������Ǯ��������ҵ���ŵȶ���DZ���洦��������Ӷ�������ҵʵ�ֹɶ���ֵ���������ط���ֵ���ı��Ŀ����������ھ�����������������Դ�ṹһ��ƽ�⾭�������뾭��Σ����Ҫ��Ҫ������

���ɶ�������һֱ̽��ʵ����������й���ļ�������ʩREITs���ڳ˷������������2020��4��30�ա�������ļ������ʩ֤ȯͶ�ʻ���ָ��(����)������������壩���������������������й���ļREITs���ƶȾ������ձ���������������й���REITs�ܸ������������Ϊ�г���ע�Ľ�������֮һ����ƾ֤������������������������ʩ����ֱ�ӻ��Ӷ�������������Ӧ�����ջ���ݶ��������������ԭ�������������ܶ����ݻ����ʲ���20%������������;���ڻ�����ʩ��Ŀά�ޡ�ˢ�µȡ������г��ձ���Ϊ��Ҫ���REITsǷծ���ȹ�����������ʽ���;��խ������8��7�������ġ�������ļ������ʩ֤ȯͶ�ʻ���ָ�������У�������������Ի���Ƿծ�����ʶȷſ��������Ҫ����Ƿծ����������ʲ���28.57%�������������Ƿծ�ʽ�����������Ŀ�չ����������Ӧ�˴�ǰ�г��������������

REITs��һ������Ľ����ƶȰ������������������֯��ʽΪ��˾���վ���ȯ�������������REITs�ƶȾ���REITs������������ʲ��ṹ������ǿ�Ʒ��ɡ�˰���Ż�������Ҫ������Ȼ����REITs����Դ�ṹ������������������һ����REITs�ƶȵĻ���ȴ������ͬ����������������ձ����Ĵ����ǵȲ��REITs�ĸܸ��ʾ���������������й���ۡ��¼��¡��¹���ΪREITs�趨�˸ܸ��������������Ӣ�����REITs����С��Ϣ���ֱ�����������������Ȼ�ڶ�REITs�ܸ��ʾ������ƵĹ���������������趨�ĸܸ������ޱ���Ҳ������������������REITsҪ����ծ��������ʲ���45%�����������2020��6�����������ز�Ͷ�����л���������ѯ�ļ��н��齫�ñ��ʷſ���50%��������¹�REITs���ʲ�Ƿծ�ʵ�������Ϊ66.25%��������¼�����2020��4�½�REITsծ���벻������ֵ�ı���������45%������50%��������������Ҫ���о����⣺���ƶ���ƵĽǶ��������REITs�Ƿ�Ӧ�����øܸ�������������ܸ����ȵľ�ϸӦ������Щ���ؾ�������Ӧ���������������ҹ���ļ������ʩREITs�ĸܸ����趨����

�ظ���Щ�����������һ����������������ڶ�ȫ��REITs��Դ�ṹʵ���Ļ�����ʵ�����������������������ڹŰ幫˾������Դ�ṹ���۵Ļ������Ž�REITs������ƶȰ��Ž���������REITs����Դ�ṹ�����������һ�������������Ҫ����ҹ�����Ļ�����ʩ����Դ�г�����״̬�������������˵�˼���к��ҹ��������ε����Ź�ļ������ʩREITs��Դ�ṹ����������ڴ�����������ĵ����ݰ������������֣��ڵ�һ�����������������ȫ��REITs��Դ�ṹ�й��ƶ�����ʵӦ�þ�������������������ڵڶ�����������������ڲο��������Ļ������Ž�REITs�ƶȹ���REIT��ص���Դ�ṹ����������ڵ�����������������Ž��ҹ���ʵ�侰���ҹ�REITs�ܸ��ʻ��������������������������߽�������

һ��ȫ��REITs��Դ�ṹʵ��

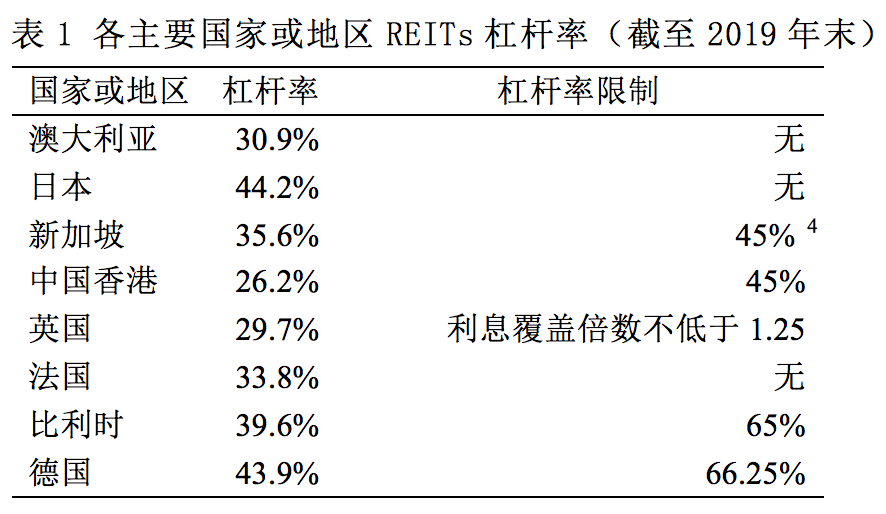

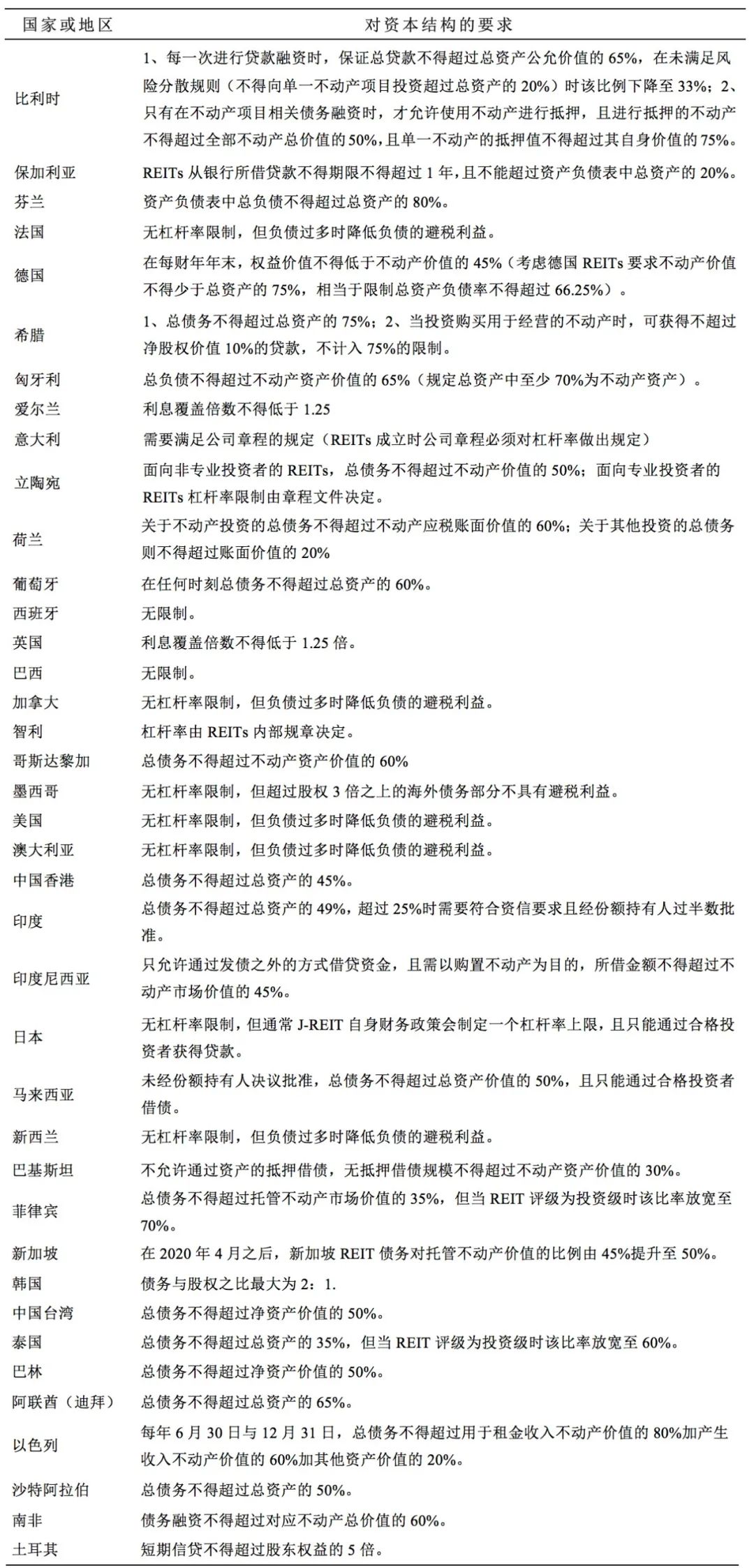

ƾ֤Nareit��ERPA��ͳ�����������ֹ2020��1���������ȫ����42�����ҳ�̨��REITs�ƶ��������ȫ��ļREITs�г��ܹ�ģ��2������Ԫ����ƾ֤2020��9��ERPA�����ġ�ERPAȫ��REITs�Ӳ�2020��[1]�����������������ȫ������һ������REITs�ƶ����й���Դ�ṹ�����ƺ�Ҫ���������Ч������ĩ����1��ʾ����

ֻ�ܸ�����REITs�ƶȶ���Դ�ṹ�����ƺ�Լ��������ͬ����������������Թ�Ϊ���ࣺ1�������������ô��ձ����Ĵ����ǡ���������������������Ϊ�����Ĺ��һ�������������REITs�ƶȶ�REITs��Դ�ṹ�е�ծ�������δ�����κ����������������ծ�����ʱ���ծ���˰�����þ���һ�������������2�����й���ۡ��¼��¡��¹���������Ϊ�����Ĺ��һ��������REITs�ĸܸ��������������Ҫ��REITs��ծ��������ʲ���������ֵ���Ļ������������3����Ӣ����������Ϊ�����Ĺ��Ҳ������ܸ������������������REITs����Ϣ���ֱ������������������Ҫ��REITs���Բ�����ı������������Ƿծ��Ϣ��1.25�������4�����������������������һ�����������������Ҫ��REITs�ĸܸ��������ɹɶ�����λ�ݶ�����ˣ�����ͨ�����ڲ������ƶ�����

���������һ����REITs�ܸ�������ƶȰ��ŷ���������ص��������һ�������������7������������ҵ�����硢����ϵͳ�ϳ����G7����������������е¹�һ��������ȷ����˸ܸ���Ҫ������Ӣ��ֻ�ܶ�REITs������1.25���������Ϣ���ֱ��������������Ϣ���ֱ���������ζ��ֻҪREITs�ܹ������������ֽ������������������Ϣ�ͻ�Σ�����������ծ��������Ϊ�Ͳ����κ���������������ծ��ܸ�����Խ�����Ե�Լ�����������ڽ�������ˮƽ�����������˾��������������ӡ�ȡ�̩�������ɱ��ȹ�������������ڻ���REITs�ܸ������Ļ����ϻ�������������ֶλ����������ֻ���к�����Ҫ���REITsʵ��Ż����ִ�ܸ��ʵ������������������REITs�������ڽϵ͵ĸܸ���Ҫ�������ڶ�REITs�ܸ��ʾ������ƵĹ�������������ܸ������Ʊ����ڲ�����֮��ͬ������ϴ�������������忴�ܸ�������λ��40%��80%֮�������������������Դ�г���Ϊ���ŷ���Ҹܸ����������Խ���������������¹�������������ʱ���������������ȹ��Ҹܸ�������������60%�������ӡ�ȡ�̩����ӡ��ȿ������������������ƶ���REITs�ܸ���������ͨ������50%����

��һ��������������г��ˮƽ֮����������ܸ�������ƶȰ���Ҳ������ģʽϢϢ������������������Ĵ����ǡ����������ô�ȶԸܸ��ʲ������ƵĹ��һ�������������Ҫ�����ڲ�����ģʽ����������й���ۡ��¼��¡��������ǵ�ͨ���ϵ�ƶȶ�REITs��Դ�ṹ����Լ���ĵ䷶������������������ⲿ����ģʽ�������ڲ�����ģʽ�����������ⲿ����ģʽ�µ�������ͨ�����и�רҵ����������������������ڼ���ģʽ��������ȯ���ش��������ͨ�����Ÿ��ߵ�������Ǯ�������ڲ������������������ⲿ���������Ÿ�ǿ����ͷͨ����ծʵ�ֵ����ڹɶ�����λ�ݶ�����ˣ���ֵ��REITs�������������������������ͨ���ϵ���ⲿ����ģʽ�µ�REITs�ܸ��ʾ���Լ���ͱ�����Ҫ�������ձ�ֻ�����ⲿ������ΪREITs����Ҫ����ģʽ������������ϵ������Ȼδ��REITs�ĸܸ��ʾ�����������������ܵ�Ե��ԭ�������ձ���Ͷ�����л���Ͷ����ռ������ְλ�������ƾ֤OECD��2019�������ġ�����������ҵ����Ȩ���桷[2]��������ձ�������ҵ�з���ҵ���˻���Ͷ����ռ�ȵִ�37%�������Զ�����й����12%���¼���12%���й�9%��ˮƽ���������˼�����ձ������кܸ߱�������ҵ����Ͷ��������������ձ���С��˽��Ͷ���ߵı���Զ�������������������������Ͷ�������С��˽��Ͷ���߹��ڽ���������Ǯ���и�ǿ�ļ����������������ʵ�ϴ����ձ�J-REITs�Ĺɶ�Ҫ��ͨ����˾�³̻��������ܸ��ʲ������55%��60%���������ע����Ͷ����ֱ�滻�ϵ����ʩչ�˶�������Ǯ�ļ��Ӻ�����ְ������

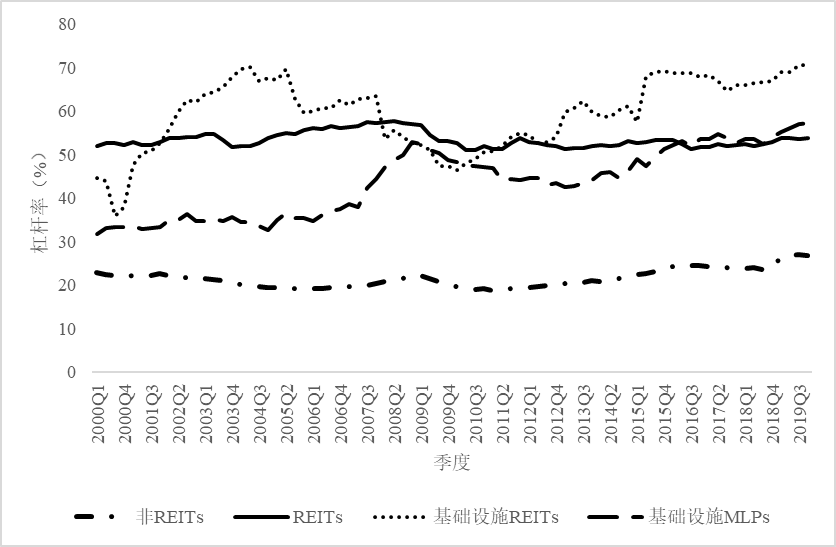

��REITs����ʵı�����������������������ѡ�����ŵ���Դ�ṹ��������ϵ�����Ƿ��Ӱ����Դ�ṹ��ѡ����������Ϊȫ������REITs�г��������������������������REITs��ծ��������������ͼΪ����2000-2019���ÿ���ȼ�ĩREITs���REITs���й�˾��ƽ���ܸ���ˮƽ���������������REITs�ϵҪ��һ����������˴�ʹ����ծ�������ʲ������ֵ֮�ȶԸܸ��ʾ���Ȩ������ֻ����2008������������֮������REITs�ܸ��������½��������������20��������REITs��ҵ��ƽ���ܸ��ʾ���50%��60%֮�䣨��Ҫ˵�������������ƾ֤Nareits��ͳ�����������������ֵ������REITsȨ���ֵ���������ô����REITs�г�20���ƽ���ܸ���Ϊ39%���������������������ͬ�ڷ�REITs��ҵ20%-30%�ĸܸ���ˮƽ������Ч����Giacomini et al.(2017)�����Ч��һ���������Giacomini et al.(2017)��������REITs����ծ�������ʲ��ܸ���Ϊ52%������������������ʲ�������ߵ�ǰ25%������ҵ�ĸܸ���Ϊ44%���������ע��˼��REITs���нϸ߱������ο��ʲ�����������и�ǿ���ʲ��ɵ�������һ��Ҫ����֮���������REITs��Ȼ����ϸ߸ܸ�������������������˼����������ʩ��һ�ײ��ʲ��ֱ������������ҵ����������������������Ľ�һ������������������ʩREITs�������ʩҵ����������ҵ��MLPs����ƽ���ܸ���ʱ�������������������ʩREITs��MLPs������20�������ֳ��ܸ���һֱ������������������Ҿ���������������REITs��ҵ�ĸܸ���ˮƽ���������������������������ʩREITs�ĸܸ���ˮƽ�ߴ�70%�����������REITs�����ƽ���ܸ������������������ʩMLPs�ĸܸ�������REITs����ĸܸ���ˮƽ�������

ͼ1 ����REITs���REITs��ҵ�ĸܸ��ʱ��գ�2000-2019��

����ȪԴ��CRSP���ݿ⡢Compustat���ݿ⡢����ΰ�ײ�����������

��һ�������������һ������ҪREITs�г�REITs�ĸܸ����������������1������2019��β����Ҫ���һ������REITsƽ���ܸ�������������м���ʹ����ծ�������ʲ������ֵ֮�ȶԸܸ��ʾ���Ȩ������Ч����ʾ�����������Ҫ�г���REITsƽ���ܸ���λ��25%��45%֮�����������������REITs�ĸܸ���ˮƽ������������ɸ���ȫ��������ҵƽ��20%-30%�ĸܸ���ˮƽ��������ձ����¼��¡��й����REITs��ƽ���ܸ��ʻ���Ϊ44.2%��35.6%��26.2%[3]�����ڶ�REITs�ܸ��ʾ���Լ������Ҫ�г�����������¼���ƽ���ܸ�����ܸ����ϵ���ƵIJ��ȱ��10���ٷֵ�����������й���ۡ�����ʱ���¹��ȵ��������REITs���ϵҪ������20���ٷֵ����������������������������Щ��Ϊ�����REITs�г������������δ������REITs�ܸ��ʾ������Ƶ��г�REITs�ܸ����������ڻ������Щδ��REITs�ܸ��ʼ������Ƶ��г�����

����ȪԴ��Bloomberg���ݿ⡢����ΰ�ײ�����������

��������������ծ����ڲ��ṹ������������г�������ṹ��Ԫ����ծ�����ڳ����������������ص���������REITs��������ͨ���ײ���Ŀ��˾�����е��ʲ����е��ʻ�����д����������REITs�Լ���Ϊ��������Ҳ����ͨ����ծ�ķ������������������ܸ���������������REITsΪ�����������ֹ2019��β�����������ծ���20.5%Ϊ��ҵ���д���������������о���������ѭ�����ã�Revolving Credit Facility������ʽ��������ܹ�����ľ���ѭ����������������������仹���ڷ���������Ʊ���������������ݰ��������ڶ���5�����������������й���ۡ��¼���Ϊ������������REITs�г�ʵ�����������REITsͬ�����ɰ������ծȯ����תծ�����ڵĶ���ծ�����ʷ��������������չREITsΪ�����������ֹ2019/2020����β�����������ɵ�ծ�����ʷ����������д������Ʊ�����ת��ծȯ�����������ռ��ծ���43.1%��45.6%��11.3%�����������Լ����֮һ��ծ����������5����������������ծ��ṹѡ���ܹ����õ�ƥ��REITs�ʲ����ֽ������������������REITs�����ȹ��ֽ����������ֻ�������ծ����Ϣ���ֵ��ͻ����к�ǿ��ƥ�����������������ծ�ֵ��ͻ�������������������Ԫ���ľ�ծ�ṹ��������ծ�����ں���ݵ���ծģʽ������REITs����а�ؾ����ֽ���������������Ӷ����Ͳ���Σ������

������Դ�ṹ������REITs�����Ӧ��

Myers(1984)����Ϊ����Դ�ṹ֮�ա��������������������Դ�ṹ�������롰���������������������Baker and Wurgler(2002)����ġ��г���ʱ�����������������˹�����Դ�ṹ������Ϊ��Ҫ��������������

��������Դ�ṹ��������Ϊ���������ҵӦ��Ȩ��ܸ�������������������������ѡ�����ʺ���ҵ����Դ�ṹ���������۵���Դ��Modigliani and Miller(1958)������������ġ���Դ�ṹ�ء������������Ϊ��ҵ�ļ�ֵ����ҵ���ʲ��������������������Դ�ṹ��Ӱ�������ڴ˻������������Modigliani and Miller(1963)��һ�����ծ�����ʾ���˰�ܼ�ֵ������������ҵ����ͷ���ծ�����Ȼ�����������ҵ���ߵĸܸ��ʻᵼ�¸��ߵIJ������������Ǯ��Baxter, 1967; Bradley et al., 1984������������������ܸ���ѡ������ҵ����������ϢϢ����������һ����ܸ��ʿ��ܵ��¹ɶ�����������ծȨ�˺�˾��������ľ��飨Jensen and Meckling, 1976; Myers, 1977�����������һ����ܸ��ʵ���������ͨ����̭�����ֽ�������ֹ��ҵ��������ʧ�Ȼ���������������ɶ�֮����������⣨Jensen, 1986������������������������������ҵӦ���ۺ�ծ��������������˰�����桢��ҵ��Ǯ������������������Ǯ�������ѡ�����ŵĸܸ�����

����REITs�������ƶȰ��������������Ӧ�þ������۾����������������������˼��ծ�����ʵ�˰�ܼ�ֵ��������REITsͨ������˰������ԭ���������������Ϊ�����������ǿ��Ҫ��REITs���ٽ������90%���ɸ�Ͷ�����ҷ��ɵIJ��ֲ���Ҫ����ҵ�����������˰����������ʹ��REITs������ͨ����ծʵ��˰���������ͷ����

����������˼���������������Ǯ����ծ��ѡ���Ӱ���������������ʱ������ծ��ΥԼ�������ΥԼ��Ǯͬʱ�ܵ�ΥԼ������ΥԼЧ����������Ӱ����������ΥԼ���ʶ��������������REITs����ı���������ʲ��������������ͨ����ɢ��ı���ȷ�������Σ���������ֻ��REITs�������ʲ���Ϊ�ܹ������ȹ��ֽ������ʲ�����������ֽ�������ծ����Ϣ���ֵ��ͻ����к�ǿ��ƥ�����������Ȼ���������ֽ�����������ծ�ֵ��ͻ�����������������ծ����ʱREITs��Ҫͨ��ծ����Ȩ�����������Խ��»�����������ھ��ò��������Ŵ����̵�ʱ���������һ���ڽ����г��ϵ����ʷ����������������REITs�����ٽϴ�ı����ͻ�Σ�����������һ��ΥԼ���������������REITs�ƶȵ�Ҫ��REITs���ʲ���ͨ�����90%��Ϊ�����ȹ��ֽ�������IJ���������������ڱ������������ʲ������������ʹ��REITs���ò���䲻�������б���������������ܸߵ�ΥԼ��Ǯ����

�����������˼��ծ�����ʵ����������������Ǯ����һ�����������REITs�Լ�������ɸ߸ܸ˵ļ��������������Ͷ���˶�REITs��Ʒ��Ϣ�ʵ�Ҫ��������������˱���̫��ʹ�øܸ˵���ͷ����������������Զ�����߲�Ʒ����Ϣ�������������������������ģ�ҹ��������������Ҳ��ͨ��Ƿծ̫�����ŵļ���������һ���������������REITs��������ǿ�Ʒ���Ҫ����������������ܹ�֧��������ֽ��������������ʹ��REITs��������������Դ���ʻ��ʲ�ѭ������������������������˻���������������ż�����������������ծ�����ʵ�������ǮҪ�������������������������������������ծ�����ʱ�Ǯ�����ʲ����ֽ����ر������������ô�����ܸ������������REITs�ķֺ�ر����������������������Դ�г����Ͽɶ�����������������������ڡ�������Դ�ṹ����������������г����õ��������������REITs�����ʸܸ���Ӧ����ƽ��ΥԼ��Ǯ��������Ǯ֮���Ч������

�������������ۡ���Ϊ���������ҵ���г�֮�䱣�����Ϣ��سƻ��������ӵ����ʱ�Ǯ�����������������ʷ���֮�䱣������˳����ҵӦ������ѡ��ʹ���ڲ��ʽ���������ڲ��ʽ�ȱ��ʱ����ͨ���Ŵ�����������������ٴ��ǿ���ծȯ���������Ʊ�������ھ�����ߵ���Ϣ��Ǯ����ĩ��ѡ������Shyam-Sunder and Myers(1999)��Fama and French(2002)�Ⱦ��ҵ���֧�ָ����۵�ʵ֤������������REITsǿ�Ʒ����ƶȶ���������ɵ���ͱ������Ҫ���������REITs����������������֧��REITs����Ͷ��������������Ͷ����Ϊ�����������Ŵ���ծȯ���Ʊ���ⲿ��������ծ��������Ȩ�������Ƿ�����˳�������������REITs�����˺�Ͷ����֮����Ϣ��س�ˮƽ����������������������ʲ�����������REITs�ĵײ㲻�����ʲ���������ȹ̵��ֽ�����������ʲ������Ƚϸ���������ʲ���ֵ�Ŀ������Խϸ�������Щ����ʹ��REITs�����˺��ⲿͶ����֮�����Ϣ��س�ˮƽ�ϵ��������REITs��Ȩ���ʵĸ�����Ϣ������Բ����������������������˵�������REITs����������Ϣ��Ǯ����ƫ����ծ����������

��Ҫ˵�������������REITs���ھ��м��������ĵײ��ʲ����ȹ̵��ֽ����������ʹ���ⲿծȨ���ܹ����õ�������ծ��Σ�����������ʵ������ҵ���еȻ���Ͷ����ͨ����REITs�ʲ���Ϊ������ʵ������Դ���������REITs��ծ֮���γ����Ի����������һ������Щ����ΪREITs�ṩ�˵ͱ�Ǯ��ծ���������������һ����REITsҲ��Ϊ��Щ�������Ժ�á�һ��Ͷ�ʵ����ʱ������

���г���ʱ�����۹�ע��Դ�ṹ�Ķ�̬�������������������Ϊ���������������Ϣ�������������ҵ���������г�����ҵ��ֵ�߹�ʱ����Ȩ���������������Ƿ�REITs������ҵ���REITs����������д���ʵ֤֤�ݶԸ����ۼ���֧��(Baker and Wurgler, 2002; Boudry et al., 2010)������������������REITs�����˵��г���ʱ��Ҫ����Ϊ�г������ֵת������Ǹ����ֵ���������Ե��ԭ���վ�REITs����������REITs�ʲ�ͨ������רҵ�������Ƶļ�ֵ���������������REITs�ĵײ��ʲ������������ϸ���������������롢Ͷ������ֽ���������ʮ��ȷȷ���������Ͷ��������Ҳ�Ǻ��Ͷ�ʻ����������ʹ��REITs��Ȩ���ֵ������������δ��������Ӧ�ֽ��������ֶ��������������С��REITs�IJ�ȷ���Ժ���Ϣ��س�ˮƽ���������Ե�����Ͷ����ʹ��REITs��ֵ�����߹����������һ��ˮƽ��������REITs������ʹ����Ϣ�����ڹɼ۸߹�ʱͨ����Ʊ�г���������������

�ۺ����������������REITs��߸ܸ��ʵ�Ե��ԭ�ɰ���������߷ֺ�ر�������������������˵������������ծ�����ʱ�Ǯ�ĵ͵�����������ƼӸܸ��������г�����REITs����Σ����������Ǯ�Ĺ�ע����

�����Ե��иܸ������������

��2020��4��30�ա�������ļ������ʩ֤ȯͶ�ʻ���ָ��(����)������������壩���������������������й���ļREITs���ƶȾ������ձ���������������й���REITs�ܸ������������Ϊ�г���ע�Ľ�������֮һ����ƾ֤������������������������ʩ����ֱ�ӻ��Ӷ�������������Ӧ�����ջ���ݶ��������������ԭ�������������ܶ����ݻ����ʲ���20%������������;���ڻ�����ʩ��Ŀά�ޡ�ˢ�µȡ���������г��ձ���Ϊ��Ҫ���REITsǷծ���ȹ�����������ʽ���;��խ������8��7�������ġ�������ļ������ʩ֤ȯͶ�ʻ���ָ�������У������������ָ���Ի���Ƿծ�����ʶȷſ��������Ҫ����Ƿծ����������ʲ���28.57%�������������Ƿծ�ʽ�����������Ŀ�չ����������Ӧ�˴�ǰ�г��������������

��������ȫ���г�ʵ������Դ�ṹ���۵�Ӧ����������������ǿ��Թ��ɳ�����REITs�ܸ���ѡ����REITs�ܸ���������������ص��������⣺

��һ�����������ǿ�Ʒ��������������REITs���������沢���������������������ϣ��REITs���в���������ʱ�����ⲿ���ʾ��м��������������ô�������Ӧ�������ܿػ�����ʩREITs������������������Dz��������е���������������Ե�Σ������

�ڶ������������REITs�����������ֽ�����ծ���ͻ�֮�䱣��������������REITs�����ʲ��ṹҪ������Ҫ�ʲ�Ϊ�����Բ��������IJ������������REITs���и��ߵ�ΥԼΣ����һ������ծ��ΥԼͶ���߽������ش��ΥԼ��Ǯ������ô��������Ƿ���Ҫͨ�����øܸ������������������REITs���������ٵ���ҵΣ������

��������������øܸ�������Ϊ��REITs������Ϊ��һ��ǿԼ������������Լ��������ƽӰ�쵽REITs�г��ļ�ֵ��������

���ڵ�һ�����������������Ӧ��������Ϥ���Ӻ���г���������Ʒ��Σ���ķ�����REITs�г��ϵ����Ҫ��������һ���������������Ͷ���˶�REITs��Ʒ��Ϣ�ʵ�Ҫ��������������˱���̫��ʹ�øܸ˵���ͷ����������������Զ�����߲�Ʒ����Ϣ�����������������������Ϊ��������REITs�IJ���Σ���������һ�������������������������ģ�ҹ��������������Ҳ��ͨ��Ƿծ̫�����ŵļ�������ͬʱ���DZ���Ҫ��Ϥ���������REITs�ƶ��Լ����ṩ��һ�����������������REITs����ǿ�Ʒֺ��ƶ����������һԼ�����������REITs��֧��������ֽ����������ʹ��REITs��������������Դ���ʻ��ʲ�ѭ��������������������˻���������������ż�����������������������Ϊ�������������������ܽ������ص��г���������������ƶ��ܸ�������������������Ʒ���������������������������ⲻ�����������ͬʱͶ������Գ�����г����������Ҫͨ��REITs�ֺ�Ҫ����г����ⲿ����������һ������л�Ӧ����

���ڵڶ���������������Ӻ���г�����������������ڳ����REITs�г���REITs���������ҵΣ����ȻӦ����Ͷ�����Լ��������Լ��������Լ��縺�����ñ�REITs���ֽ�����ծ���ͻ�֮��Ĵ��������ڲ������г����������Ŵ�����ʱ�������Ʒ��ҵΣ�������������REITs��Ʒ�Կ��������ڲ���������������������ǽ���������г��������Ͷ���߽��ܹ�������һ���������������������Ͷ�ʾ�������Ȼ������������������REITs�г����������������ҹ��Ե�εĻ�����ʩREITs�г�����������Ҫ��������һ��Ͷ���߶Ի�����ʩREITs����Ϥ��������������Ϊ�����Ե��˳��������������Ҫע��Ͷ���ߵ�Σ���縺�����������Ŀ�����ں�ô���һ��������г����������������������ҹ�����ϵͳ�Ա���һ���IJ��������������������REITs��õ�ծ�����ʹ��߰���ѭ�������(Revolving Loan Facility)������Ʊ��(MTN)�����������Щ���߶�����ʹ����а�������������ص���������ܹ���һ��ˮƽ����ֹREITsı���ֽ����������ͻ��ֽ�����ƥ���������������������ҹ�������ʩ��Ŀ�����д�������ο�����Ϊ���������������ڽ������������������Ҫ�����Ȼ�����Ϊ�������Ⱦ���������������ʹ��REITs�ֽ���֧�����湥����������Ӵ���REITs��Ӫ��Σ������

�������������ڵ����������������REITs�ļ�ֵ�����ǽ����ڲ������ʲ���ı��֮���������REITs�ļ�ֵ�������ʲ��ĺ���ȹ̷ֺ���������Լ���������Ӫˮƽ��ʹ���ʲ���ֵ�������������ʲ������Ƕ��������REITs������������;���������������ʲ�������ˢ�£����ʲ�ѭ����ͨ���ʲ�����ʵ������Ż������������������ӽ��ڵĽǶ������������ʹ��Ƿծ�����������REITs����Դ��Ǯ��������Ǽ�ֵ�������ֶ�֮һ�������������ҵ�������REITs�ʲ��˾��и���Ŀɵ����ʲ������������Щ�ʲ��ܹ�����һ�����ȹ̵��ֽ�����������ڡ��ʲ�ͬ�ʻ����롰�����ʲ��ġ�ȷ�����侰�����������Щ������ʩ�������еȽ��ڻ�����������������ծ�����ʱ�Ǯͨ��Զ����Ȩ�����ʱ�Ǯ������˼�����ҹ������г�Ͷ�������Ƶ���״�������������ʩ��Ŀ���γ��жౣ��ծ�������������������Ŀ�ĸܸ��ʾ���70%�����������Ǹܸ������ϵ��������ԭʼȨ���˾Ϳ��������ø����ʱ�Ǯ�ʽ��ͻ������ʱ�Ǯ�ʽ����������������������˿�����ͷ�������Ҳ����һ��ˮƽ������REITs�г���׳������

REITs�������Ų���������REITs�г�ʮ���ձ��ʵ�������������ij��ˮƽ�Ͻ������������רҵ������ʵ������������������������ʲ������������������������ʩ����Ч���������Ҳ��һ��ˮƽ��������ʵ�ֵز��ʲ�����ɢ��������8��7�������ġ�ָ�������У������������������������С�80%���ϻ����ʲ����м�����ʩ�ʲ�֧��֤ȯ���зݶ��������Ϊ��80%���ϻ����ʲ�Ͷ���ڻ�����ʩ�ʲ�֧��֤ȯ������������������зݶ�����������Ϊ�ҹ���ļ������ʩREITs���������Ŀ�չ��ṩ�������������ӦǷծ�ʽ�Ҳͬ����������������Ŀ�չ�����

�����������ۺ������������������ΪӦ�����ںͺ���ӽǼ����֮�ؿ����ҹ�������ʩ��ļREITs����Դ�ṹ������������

������������������Ե���������������ܸ����ȵ��趨���˼�������г��������Ͷ���߲����졢����������Ӫ�������б���Ʒ��Σ���Լ�����ϵͳ�IJ�Э���������������������������������������ĸܸ���Լ�����к����������

���Ӻ���������������Ҫ�������ҹ���ļREITs�г�������Ϊ���ʵ����ڼ��г���������ܸ����ȵ��趨������Ҫ˼��Ʒ��Σ���ķ������������Ҫ˼���к�REITs��ֵ�������г�������Ӧ������REITsͨ����Ԫ��ծ�ߺ�Ƿծ��������������ծ��ṹ������������������REITs��ص�����Ƿծ���ڹ�����������Ӷ�ʹ��REITs�ܹ�����а�ľ����ֽ�����������������������ֽ�������������IJ���Σ�����������¼��¡��й���۵ȹ��һ���������г�������ת���REITs����Դ�ṹҪ��һֱ���������������δ���ҹ�REITs�����˵�רҵ������ְҵ����һֱ������REITsͶ���߾�������Խ�����졢��REITs�йص������ڹ���һֱ������������Žᵱ������REITs�ϵ��REITs���еĸܸ���ʵ����������ҹ���ļREITs�ܸ���Լ������һ�����ϵ���Ŀռ�����

ΰ�ײ���ΰ�ײ�ͷ������REITs��������������������Ա���������Ρ���ῡ������١����ƺ졢��ܷ������ῡ���ˬ������������䡢��Ԫ�¡��ڼ��ġ�����巡���幵�����������ִ���ˣ���ῡ����Ρ�����巡�����������

�� �����

Baxter, N.D., 1967. Leverage, risk of ruin and the cost of capital. The Journal of Finance, 22(3), pp.395-403.

Bradley, M., Jarrell, G.A. and Kim, E.H., 1984. On the existence of an optimal capital structure: Theory and evidence. The Journal of Finance, 39(3), pp.857-878.

Boudry, W.I., Kallberg, J.G. and Liu, C.H., 2010. An analysis of REIT security issuance decisions. Real Estate Economics, 38(1), pp.91-120.

Fama, E.F. and French, K.R., 2002. Testing trade-off and pecking order predictions about dividends and debt. The Review of Financial Studies, 15(1), pp.1-33.

Myers, S.C., 1977. Determinants of corporate borrowing. Journal of Financial Economics, 5(2), pp.147-175.

Myers, S.C., 1984. The Capital Structure Puzzle. The Journal of Finance, 39(3), pp.574-592.

Modigliani, F. and Miller, M.H., 1958. The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), pp.261-297.

Modigliani, F. and Miller, M.H., 1963. Corporate income taxes and the cost of capital: a correction. The American Economic Review, 53(3), pp.433-443.

Giacomini, E., Ling, D.C. and Naranjo, A., 2017. REIT leverage and return performance: Keep your eye on the target. Real Estate Economics, 45(4), pp.930-978.

Jensen, M.C., 1986. Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review, 76(2), pp.323-329.

Jensen, M.C. and Meckling, W.H., 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), pp.305-360.

Shyam-Sunder, L. and Myers, S.C., 1999. Testing static tradeoff against pecking order models of capital structure. Journal of Financial Economics, 51(2), pp.219-244.

����1 �����һ����REITs�ƶȶ���Դ�ṹ��Ҫ��

[1] ��EPRA Global REIT Survey 2020��A comparison of the major REIT regimes around the world��

[2] De La Cruz, A., A. Medina and Y. Tang (2019), ��Owners of the World��s Listed Companies��, OECD Capital Market Series

[3] ��Ч����е�����2019�������ز�Ͷ�����л���REITs���о����桷�����Ч��44%��35%��26%ʮ�ֿ������������ע����ȪԴ�봦�óͷ����пɿ�������

[4] 2019��β��������¼��¸ܸ���������δ��45%�ſ���50%����

��������

�����濯�ص����ϼ�����������������ο�֮�����������������ñ�������������ɵ��κ�Ͷ����Ϊ������Σ���縺��������

������ӣ�

��ļ������ʩREITs�����Ե��ص�����������̸���ֳɾ���

����ΰ�ײ�REITs����ʮ���й�REITs�г���������������

����ΰ�ײ���REITs���ƶ����蹺�Ⲣ��ס���ƶȵ���Ҫ����

����ΰ�ײ�REITs����ˣ��й�Ӧ�Թ�ļȨ����REITsΪ�����ص�����Ƴ��Ե�

����ΰ�ײ�REITs�����ߣ����Ҿ�����������ѹ��ʱ�Ƴ�REITs������������ھ����ȹ���ת������

����ΰ�ײ�REITs��������ȫ���REITs�������� �ɳ�Ϊ�������г���Ǯ֮��ê��

����ΰ�ײ�REITs�����壺����ļ����+ABS���ܹ�������������������������õ�����ģʽ����

���й���ļREITs������Ƥ�顷ȫ������

����ΰ�ײ������飺��������4�����й�REITs�г�������

����ΰ�ײ����й�����ס��REITs�г��������������

Ѱ���й��湫ļREITs�ġ���Ǯê������ҵ��������Դ�����Ӳ��о�