иҝ‘е№ҙжқҘ�пјҢжҠҠеҸҜжҢҒз»ӯејҖеұ•зҡ„зңӢжі•жҖҖжҠұеҢ–зҡ„ESGпјҲеҚіжғ…еҪўEnvironmental�гҖҒ�гҖҒгҖҒзӨҫдјҡSocialе’ҢжІ»зҗҶGovernanceпјүи¶ҠеҸ‘еҸ—еҲ°зӨҫдјҡеҗ„з•Ңзҡ„жҷ®йҒҚе…іжіЁ��пјҒ�пјҒ

е…Ӣж—Ҙ�пјҢд»ҘвҖңдёҺж—¶д»ЈеҗҢйў‘ еҘӢиҝӣе•ҶеӯҰж–°еҫҒзЁӢвҖ”вҖ”зҷҫе»ҝеҢ—еӨ§е•ҶеӯҰ�пјҢжҺЁиҝӣвҖҳеҸҢдёҖжөҒвҖҷеӯҰ科е»әи®ҫвҖқдёәдё»йўҳзҡ„第дәҢеҚҒеӣӣеұҠеҢ—еӨ§дјҹжҳ“еҚҡж–°е№ҙи®әеқӣеңЁзәҝдёҠеҸ¬ејҖ��пјҒ�пјҒ�пјӣ�пјӣеөҳ�пјҢдјҹжҳ“еҚҡеҚўжө·ж•ҷжҺҲдҪңдәҶйўҳдёәвҖңдёӯеӣҪдёҠеёӮе…¬еҸёESGе®һи·өе’Ңз ”з©¶вҖқзҡ„жј”и®І��пјҒ�пјҒ

дёәд»Җд№ҲиҰҒеҒҡESGпјҹ�пјҹ�пјҹ

дёҖз§ҚзңӢжі•д»Ҙдёә�пјҢеҒҡESGзӣёе…ізҡ„дәӢ�пјҢд»ҺжҒ’д№…жқҘи®І�пјҢжңҖз»ҲеҸҜд»ҘиҺ·еҫ—иҙўеҠЎдёҠзҡ„еӣһжҠҘ��пјҒ�пјҒ

еҸҰдёҖз§ҚзңӢжі•д»Ҙдёә�пјҢдёӘдәәеҒҡESGзӣёе…ізҡ„дәӢдёҚеҰӮз”ұдјҒдёҡжқҘеҒҡжңүз”Ё�пјҢд»ҘжҳҜжҠ•иө„ESGеҒҡеҫ—еҘҪзҡ„дјҒдёҡ��пјҒ�пјҒ

еҲ«зҡ„�пјҢе°ҡжңүдәәдҪ“зҺ°�пјҢеҒҡESGдёҚе®Ңе…ЁжҳҜдёәдәҶиҙўеҠЎзҡ„еҺҹеӣ �пјҢз”ұдәҺе®ғеҜ№жғ…еҪўе’ҢзӨҫдјҡеӨӘдё»иҰҒдәҶ�пјҢеҪұе“ҚдәҶдәәзұ»жҒ’д№…ејҖеұ•е’Ңе№ёзҰҸж„ҹ��пјҒ�пјҒ

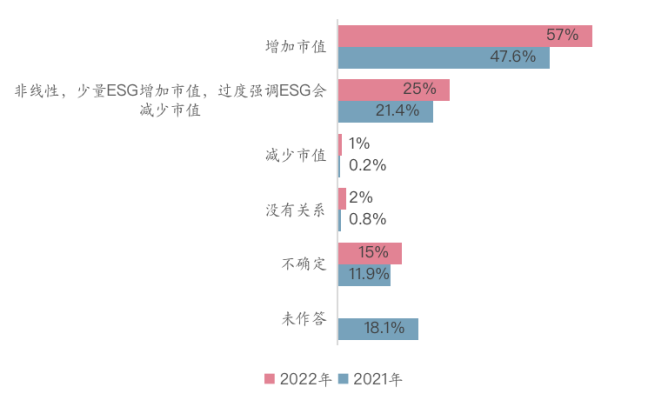

дёәдәҶжҺўеҜ»дјҒдёҡ家жҖҺж ·зңӢеҫ…иҝҷдёӘй—®йўҳ�пјҢеҚўжө·з ”究еӣўйҳҹеңЁ2021е№ҙе’Ң2022е№ҙеҲ’еҲҶеҜ№4000еӨҡ家дёӯеӣҪзҡ„дёҠеёӮе…¬еҸёи‘ЈдәӢдјҡдёҫиЎҢдәҶй—®еҚ·и§ҶеҜҹ�пјҢеқҮ收еҲ°400еӨҡд»ҪеӣһеӨҚ��пјҒ�пјҒ

дёҠеёӮе…¬еҸёеҜ№ESGжҠ•иө„жҳҜеҗҰеўһж·»еёӮеҖјжңүдёҖе®ҡеҲҶжӯ§

е…¬еҸёд»ҘдёәESGжҠ•иө„е’ҢеёӮеҖјд№Ӣй—ҙзҡ„е…ізі»

е…¬еҸёеҜ№ESGжҠ•иө„еҚ е…¶й”Җе”®йўқзҡ„йў„жңҹ

жіүжәҗ:дјҹжҳ“еҚҡ-зҪ—зү№жӣјдёӯеҝғ�пјҢ2022е№ҙеәҰESGдҝЎжҒҜиҙЁйҮҸе’ҢйҖҸжҳҺеәҰжҢҮж•°зҷҪзҡ®д№Ұ

е…ідәҺдёҠеёӮе…¬еҸёжҖҺж ·зңӢеҫ…ESGжҠ•иө„е’ҢеёӮеҖјд№Ӣй—ҙзҡ„е…ізі»�пјҢй—®еҚ·з»ҷеҮәдәҶеӨҡдёӘйҖүйЎ№пјҡ第дёҖдёӘйҖүйЎ№�пјҢESGжҠ•иө„дјҡеўһж·»еёӮеҖј�пјӣ�пјӣ第дәҢдёӘйҖүйЎ№�пјҢе°‘йҮҸзҡ„ESGеҸҜд»Ҙеўһж·»еёӮеҖј�пјҢеӨӘиҝҮејәи°ғESGдјҡй•Ңжұ°еёӮеҖј�пјӣ�пјӣ第дёүдёӘйҖүйЎ№�пјҢESGжҠ•иө„дјҡй•Ңжұ°еёӮеҖј�пјӣ�пјӣ第еӣӣдёӘйҖүйЎ№жҳҜжІЎжңүе…ізі»�пјӣ�пјӣеҲ«зҡ„�пјҢдёҠеёӮе…¬еҸёд№ҹеҸҜйҖүжӢ©дёҚзЎ®е®ҡжҲ–дёҚдҪңзӯ”��пјҒ�пјҒ

еҰӮдёҠеӣҫжүҖзӨә�пјҢжҲ–и®ёжңүдёҖеҚҠзҡ„дёҠеёӮе…¬еҸёд»ҘдёәESGжҠ•иө„еҸҜд»Ҙеўһж·»е…¬еҸёзҡ„еёӮеҖј�пјҢеҗҢж—¶жңү1/4д»ҘдёәдәҢиҖ…д№Ӣй—ҙжҳҜйқһзәҝжҖ§зҡ„е…ізі»�пјҢеҚіе°‘йҮҸзҡ„ESGжҠ•иө„дјҡеўһж·»еёӮеҖј�пјҢдҪҶеӨӘиҝҮејәи°ғESGдјҡй•Ңжұ°еёӮеҖј��пјҒ�пјҒ�пјӣ�пјӣж—§еҺҰжҢҘжі„з–Ҫжҷ•зӢӨSGжҠ•иө„дјҡй•Ңжұ°еёӮеҖјжҲ–дёӨиҖ…жІЎжңүе…ізі»��пјҒ�пјҒ

и§ҶеҜҹ2021е№ҙе’Ң2022е№ҙзҡ„й—®еҚ·ж•ҲжһңеҸҜд»ҘеҸ‘жҳҺ�пјҢзӣ®д»ҠдёҠеёӮе…¬еҸёеҜ№ESGжҠ•иө„е’ҢеёӮеҖјд№Ӣй—ҙжҳҜеҗҰжңүзәҝжҖ§е…ізі»е°ҡжңүдёҖе®ҡзҡ„еҲҶжӯ§�пјҢеҜ№ESGжҠ•иө„жҳҜеҗҰеҸҜд»Ҙеўһж·»еёӮеҖјд№ҹжңүдёҖе®ҡзҡ„еҲҶжӯ§��пјҒ�пјҒ

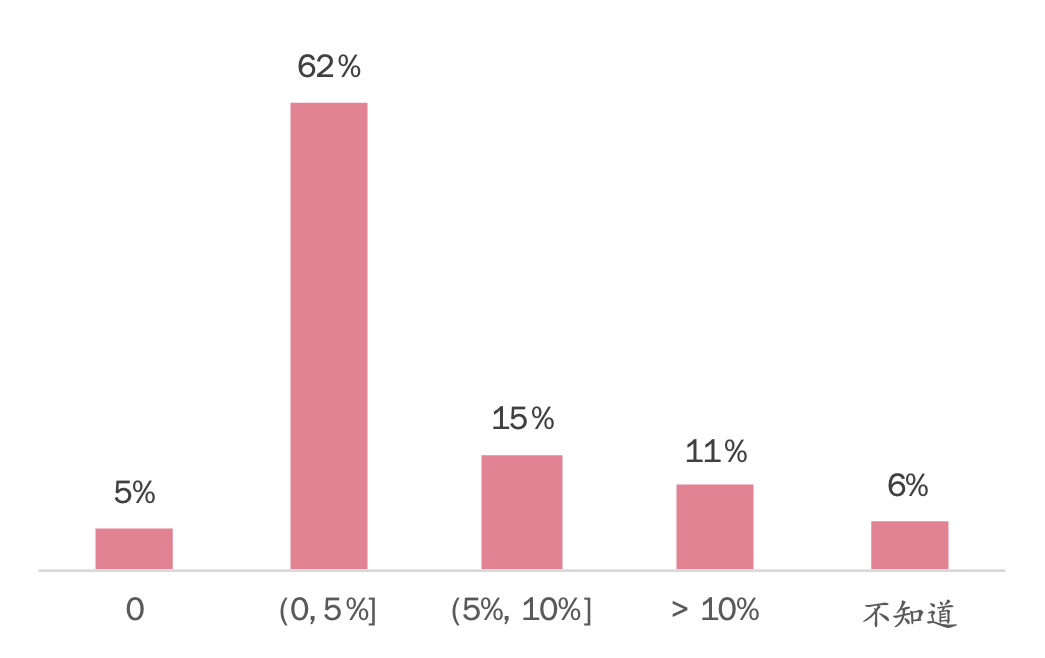

й—®еҚ·дёӯзҡ„еҸҰдёҖдёӘй—®йўҳжҳҜ2022е№ҙе…¬еҸёеҜ№ESGжҠ•иө„еҚ е…¶й”Җе”®йўқзҡ„йў„жңҹ��пјҒ�пјҒпјЁзјҰеіҰеҰ“�пјҢжңү62%зҡ„е…¬еҸёд»ҘдёәеңЁ0-5%зҡ„еҢәй—ҙиҫғйҮҸеҗҲйҖӮ�пјҢиҜҙжҳҺеӨ§йғЁеҲҶдёҠеёӮе…¬еҸёд»Ҙдёә�пјҢеўһж·»дёҖе®ҡзҡ„ESGжҠ•иө„еҜ№е…¬еҸёзҡ„еёӮеҖјжҳҜжңүеҲ©зӣҠзҡ„��пјҒ�пјҒ

еҚўжө·ж•ҷжҺҲдҪ“зҺ°�пјҢй—®еҚ·еҸҚжҳ дәҶжҠ•иө„иҖ…е’ҢдёҠеёӮе…¬еҸёеҜ№ESGжҠ•иө„дёҺе…¬еҸёиҙўеҠЎд»·еҖјд№Ӣй—ҙе…ізі»зҡ„зҶҹжӮү并дёҚе®Ңе…ЁдёҖиҮҙ��пјҒ�пјҒ

ESGеҘ‘еҗҲдёӯеӣҪеҸҜжҢҒз»ӯејҖеұ•жҲҳз•ҘзҗҶеҝө�пјҢд№ҹдёҺеӨ§еӯҰдҪҝе‘Ҫжңүе…і

жҲ‘们д»ҠеӨ©дёәд»Җд№ҲиҰҒи®ІESGе‘ўпјҹ�пјҹ�пјҹеҚўжө·дҪ“зҺ°жңүдёӨдёӘеұӮйқўзҡ„еҺҹеӣ ��пјҒ�пјҒ

第дёҖ�пјҢESGеңЁдёӯеӣҪзҡ„е®һи·өжңүиҮӘе·ұзҡ„зү№иүІ��пјҒ�пјҒпјҡиҮҖйһЈз„Ұд№ҷжҖЁе•ҘеҰ«в•Ҝhareholderпјүдёәдёӯеҝғзҡ„з»ҸжөҺдҪ“жңүжүҖе·®еҲ«�пјҢдёӯеӣҪжҳҜд»Ҙеҗ„еӨ§еҲ©зӣҠзӣёе…іиҖ…(stakeholdersпјүдёәдёӯеҝғзҡ„з»ҸжөҺдҪ“��пјҒ�пјҒпјҙи°ЎеәӢжЎ“йҡ№иҡЈиҠҹ�пјҢиҰҒжҖқйҮҸж”ҝеәң�гҖҒ�гҖҒгҖҒдәәж°‘е’ҢзӨҫдјҡзҡ„е®үе®ҡзӯүдёҖзі»еҲ—еӣ зҙ ��пјҒ�пјҒпјҰжөҜ�пјҢдёӯеӣҪдёәеҸҜжҢҒз»ӯејҖеұ•еҲ¶и®ўдәҶиө·еҠІзҡ„еӣҪ家жҲҳз•Ҙ�пјҢжҜҸдёҖдёӘдә”е№ҙеҰ„жғійғҪжҳҜд»Һд№…иҝңзҡ„ејҖеұ•жқҘжҖқзҙўзҡ„��пјҒ�пјҒпј·и©Ҳ�пјҢESGзҗҶеҝөдёҺдёӯеӣҪеҸҜжҢҒз»ӯејҖеұ•жҲҳз•Ҙдёӯзҡ„ејҖеұ•зҗҶеҝөеҚҒеҲҶеҘ‘еҗҲпјҡиӯ¬еҰӮEдёӯзҡ„еҸҢзўіжҲҳз•Ҙ�пјҢSдёӯзҡ„й…ҚеҗҲеҜҢи¶і�пјҢGдёӯзҡ„иө„жәҗеёӮеңәйҖҸжҳҺеәҰ��пјҒ�пјҒ

вҖңд»ҘжҳҜESGеңЁдёӯеӣҪзҺ°е®һдёҠи·ҹжҲ‘们еӣҪ家зҡ„жҲҳз•Ҙе’Ңд№…иҝңејҖеұ•зҡ„зңӢжі•жҳҜеҫҲжҳҜеҘ‘еҗҲзҡ„��пјҒ�пјҒ�пјҒ�пјҒз”ӯпј“��пјҒ�пјҒ

第дәҢ�пјҢESGд№ҹе’ҢеӨ§еӯҰзҡ„дҪҝе‘Ҫдј‘жҲҡзӣёе…і��пјҒ�пјҒпјқиЈүж–“еҚ—жҒјеҗҶеұҜ蹲收еҗ’е“ӮиЎ…иҝ”жҪһ驮鹑иғғ�пјҢESGжҳҜдё»иҰҒжҳҜз”ұе№ҙиҪ»дёҖд»ЈдәәжҺЁеҠЁзҡ„��пјҒ�пјҒпј–йҳ…жҳөеөӢж·®й¶ЁSGж•ҷиӮІдҪңиӮІе’ҢеҢ—дә¬еӨ§еӯҰеҸҠдјҹжҳ“еҚҡжІ»зҗҶеӯҰйҷўдҪңдёәй«ҳзӯүжІ»зҗҶж•ҷиӮІжңәжһ„зҡ„дҪҝе‘ҪеҚҒеҲҶеҘ‘еҗҲ��пјҒ�пјҒ

еҢ—еӨ§иҖҒж Ўй•ҝ马еҜ…еҲқеңЁзҷҫе№ҙеүҚи‘—еҗҚзҡ„жј”и®ІдёӯжҸҗеҲ°д»Җд№ҲжҳҜеҢ—еӨ§зІҫзҘһвҖ”вҖ”вҖңжүҖи°“еҢ—еӨ§дё»д№үиҖ…�пјҢеҚізүәзүІдё»д№үд№ҹ��пјҒ�пјҒпј—еҠЎдәҺеӣҪ家зӨҫдјҡ�пјҢжҺүиҮӮдёҖе·ұд№Ӣз§ҒеҲ© вҖҰ вҖқ

еҚўжө·дҪ“зҺ°�пјҢиҝҷж ·зҡ„еҢ—еӨ§зІҫзҘһ�гҖҒ�гҖҒгҖҒжІ»зҗҶж•ҷиӮІдҪҝе‘Ҫе’ҢеҸҜжҢҒз»ӯејҖеұ•ж•ҷиӮІзҗҶеҝөд№ҹйғҪжҳҜеҫҲжҳҜзӣёеҲҮеҗҲзҡ„�пјҢиҝҷд№ҹжҳҜд»ҠеӨ©и®ІESGеҫҲдё»иҰҒзҡ„еҺҹеӣ ��пјҒ�пјҒ

еҚўжө·д»Ӣз»ҚдәҶд»–еңЁESGж–№йқўеҒҡзҡ„дёүдёӘз ”з©¶пјҡ

第дёҖ�пјҢдёӯеӣҪжҳҜеӨ©дёӢе·ҘеҺӮ�пјҢеӣҪйҷ…з”ҹдә§й“ҫеҜ№дјҹжҳ“еҚҡз»ҸжөҺејҖеұ•еҫҲжҳҜдё»иҰҒ�пјҢESGдҝЎжҒҜзҡ„ејәеҲ¶жҠ«йңІеҜ№еӣҪйҷ…з”ҹдә§й“ҫжңүд»Җд№ҲеҪұе“Қпјҹ�пјҹ�пјҹ

第дәҢ�пјҢдёӯеӣҪзҡ„ESGзҺ°зҠ¶жҖҺж ·пјҹ�пјҹ�пјҹ

第дёү�пјҢESGе®һи·өзҡ„зҺ°зҠ¶жҳҜеҗҰдјҡеҪұе“ҚеӣҪ家ж”ҝзӯ–зҡ„ж•Ҳжһңпјҹ�пјҹ�пјҹ

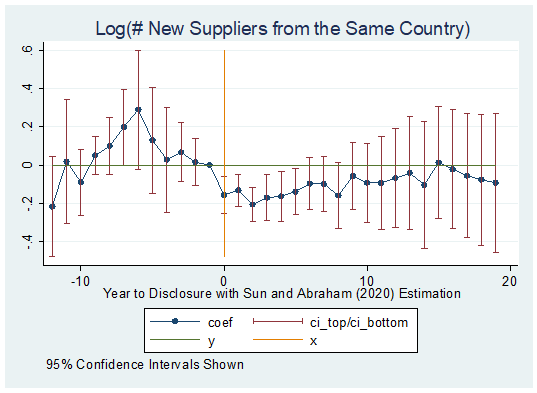

ејәеҲ¶жҖ§ESGдҝЎжҒҜжҠ«йңІеҜ№еӣҪйҷ…з”ҹдә§й“ҫзҡ„иҝҒеҫҷдјҡзҲҶеҸ‘еҪұе“Қ

ESGдҝЎжҒҜзҡ„ејәеҲ¶жҠ«йңІеҜ№еӣҪйҷ…з”ҹдә§й“ҫжңүдҪ•еҪұе“Қпјҹ�пјҹ�пјҹ

еҚўжө·дҪ“зҺ°�пјҢеҲ°2020е№ҙ�пјҢжңүеҝ«иҰҒ100дёӘеӣҪ家е®һйӘҢдәҶ350дёӘESGејәеҲ¶жҖ§и§„еҲҷе’Ң250еӨҡдёӘESGиҮӘж„ҝжҖ§и§„еҲҷ(Carrots & Sticks)��пјҒ�пјҒпјі2006е№ҙзӣёжҜ”�пјҢејәеҲ¶жҖ§зҡ„ESGдҝЎжҒҜжҠ«йңІи§„еҲҷе’ҢиҮӘж„ҝзҡ„ESGдҝЎжҒҜжҠ«йңІи§„еҲҷд»ҘеҸҠе®һйӘҢ规еҲҷзҡ„еӣҪ家数зӣ®йғҪжңүжҳҫи‘—еўһж·»��пјҒ�пјҒ

ESG规еҲҷеўһж·»еҜ№зҺ°е®һзҡ„з»ҸжөҺејҖеұ•жңүд»Җд№ҲеҪұе“Қпјҹ�пјҹ�пјҹеҜ№зҺ°е®һдјҒдёҡзҡ„иҝҗиЎҢжңүд»Җд№ҲеҪұе“Қпјҹ�пјҹ�пјҹеӣҪ家еұӮйқўе’Ңең°еҢәеұӮйқўзҡ„ејәеҲ¶жҖ§ESGдҝЎжҒҜжҠ«йңІеҜ№еӣҪйҷ…з”ҹдә§й“ҫжңүжІЎжңүд»Җд№ҲеҪұе“Қпјҹ�пјҹ�пјҹ

жө·еҶ…/ең°еҢәеҶ…移еҠЁ

移еҫҖй«ҳESGж ҮеҮҶзҡ„еӣҪ家/ең°еҢә

移еҫҖдҪҺESGж ҮеҮҶзҡ„еӣҪ家/ең°еҢә

жіүжәҗ: Lu, Peng, Shin, Yu (2022) вҖ“ Migration of Global Supply Chains: A Real Effect of Mandatory ESG Disclosure

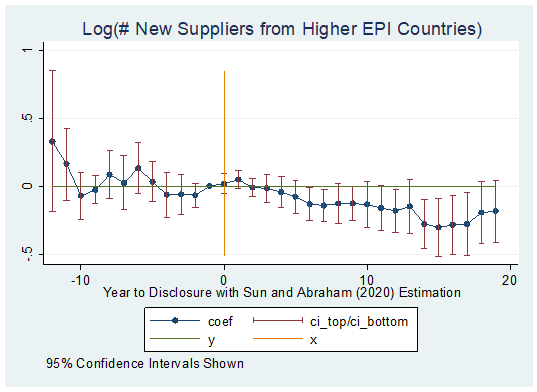

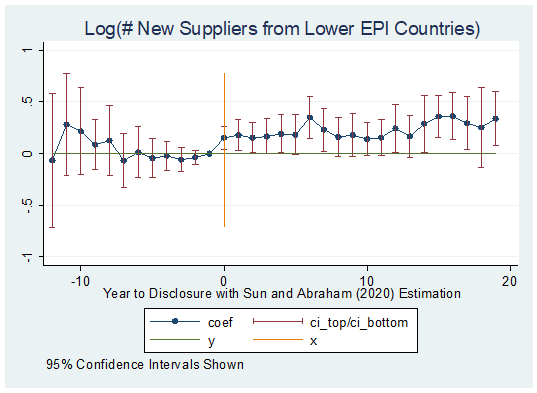

еҚўжө·дҪ“зҺ°�пјҢESGдҝЎжҒҜжҠ«йңІжңүжҳҫи‘—зҡ„еҗҲ规жң¬й’ұе’ҢеЈ°иӘүжң¬й’ұ�пјҢд»ҘжҳҜдёҖдәӣеӨ§дјҒдёҡжҠҠдҫӣеә”е•Ҷд»ҺйҖҸжҳҺеәҰиҫғйҮҸй«ҳзҡ„еӣҪ家е’Ңең°еҢә�пјҢиҪ¬з§»еҲ°йҖҸжҳҺеәҰдҪҺжҲ–иҖ…жҳҜжІЎжңүејәеҲ¶жҠ«йңІиҰҒжұӮзҡ„еӣҪ家е’Ңең°еҢә��пјҒ�пјҒ

дёҠйқўдёүеј еӣҫдёӯ�пјҢ第дёҖеј еӣҫжҳҜжқҘиҮӘз»ҹдёҖеӣҪ家зҡ„ж–°дҫӣеә”е•Ҷж•°зӣ®�пјҢжЁӘиҪҙXиҪҙзҡ„вҖң0вҖқд»ЈиЎЁејәеҲ¶жҖ§жҠ«йңІе№ҙд»Ҫ�пјҢеҸҜд»ҘзңӢеҲ°жқҘиҮӘз»ҹдёҖеӣҪ家зҡ„дҫӣеә”е•Ҷж•°зӣ®еңЁиҰҒжұӮејәеҲ¶жҠ«йңІеҗҺзҡ„еүҚеҮ е№ҙжңүжүҖдёӢйҷҚ��пјҒ�пјҒпј¶иЎҢжҒјеә№зЈҗйҷ…дәІйў‘и•үиЁЈSGиҰҒжұӮиҫғйҮҸй«ҳзҡ„еӣҪ家�пјҢеҸҜд»ҘзңӢеҲ°дҫӣеә”е•Ҷзҡ„ж•°зӣ®еңЁжҢҒз»ӯдёӢйҷҚ��пјҒ�пјҒпј·и©Ҳз¬ еҫҪзЈҗйҷ…дәІйў‘и•үиЁЈSGиҰҒжұӮиҫғйҮҸдҪҺзҡ„еӣҪ家�пјҢдҫӣеә”е•Ҷзҡ„ж•°зӣ®жҢҒз»ӯеңЁдёҠеҚҮ��пјҒ�пјҒпјўпј¬йҖ‘�пјҢиҝҷжү№жіЁејәеҲ¶жҖ§зҡ„ESGдҝЎжҒҜжҠ«йңІеҜ№еӣҪйҷ…з”ҹдә§й“ҫзҡ„иҝҒеҫҷзЎ®е®һдјҡзҲҶеҸ‘еҪұе“Қ��пјҒ�пјҒ

еҚўжө·еӣўйҳҹиҝҳиҝӣдёҖжӯҘеҒҡдәҶеү–жһҗ�пјҢеү–жһҗеёҲи·ҹиёӘзҡ„ж•°зӣ®еҮ еӨҡ�гҖҒ�гҖҒгҖҒжңәжһ„жҠ•иө„жҜ”йҮҚе’Ң规еҲҷжү§иЎҢзҡ„еҠӣеәҰ�пјҢйғҪдјҡеҪұе“ҚеҲ°з”ҹдә§й“ҫзҡ„иҝҒеҫҷ��пјҒ�пјҒ

вҖңиҫғйҮҸйҖҸжҳҺзҡ„е…¬еҸё�пјҢдёҚеӨӘдјҡз”ұдәҺESGдҝЎжҒҜзҡ„ејәеҲ¶жҠ«йңІиҖҢиҝҒеҫҷз”ҹдә§й“ҫ�пјҢзӣёеҸҚ�пјҢеү–жһҗеёҲи·ҹиёӘж•°зӣ®иҫғе°‘�пјҢжңәжһ„жҠ•иө„жҜ”йҮҚиҫғе°Ҹ�пјҢ规еҲҷжү§иЎҢзҡ„еҠӣеәҰиҫғејұзҡ„е…¬еҸёжӣҙе®№жҳ“з”ұдәҺESGдҝЎжҒҜејәеҲ¶жҠ«йңІиҖҢиҝҒеҫҷз”ҹдә§й“ҫ��пјҒ�пјҒ�пјҒ�пјҒз”ӯпј—в’ҡ�пјҢиӢҘжҳҜжҺҘзәіеӣҪйҷ…з”ҹдә§й“ҫиҝҒеҫҷзҡ„жҲҳз•Ҙ�пјҢдјҒдёҡжҠөиҫҫдәҶе®ғзҡ„зӣ®зҡ„�пјҢESGзӣёе…ізҡ„дәӢж•…жҠҘйҒ“дјҡжңүжүҖй•Ңжұ°��пјҒ�пјҒ

ESGе®һи·өзҡ„дё»иҰҒйҡңзўҚжҳҜзјәд№ҸдәәжүҚ�пјҢзҹҘиҜҶе’ҢжҢҮеј•

дёӯеӣҪзҡ„ESGзҺ°зҠ¶жҖҺж ·пјҹ�пјҹ�пјҹ

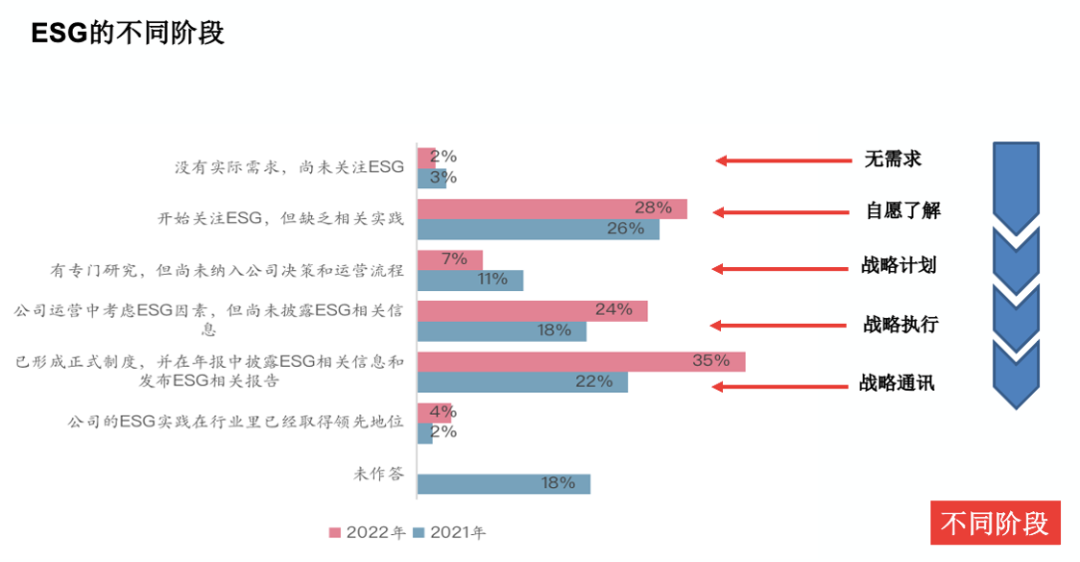

еҚўжө·иҠӮйҖүдәҶ2022е№ҙеәҰгҖҠESGдҝЎжҒҜиҙЁйҮҸе’ҢйҖҸжҳҺеәҰжҢҮж•°зҷҪзҡ®д№ҰгҖӢдёҠйқўдёҖеј еӣҫиЎЁвҖ”вҖ”зҝ»ејҖй»‘еҢЈеӯҗвҖ”дёӯеӣҪдёҠеёӮе…¬еҸёзҡ„ESGе®һи·өи§ҶеҜҹ��пјҒ�пјҒ

жіүжәҗ:дјҹжҳ“еҚҡ-зҪ—зү№жӣјдёӯеҝғ�пјҢ2022е№ҙеәҰESGдҝЎжҒҜиҙЁйҮҸе’ҢйҖҸжҳҺеәҰжҢҮж•°зҷҪзҡ®д№Ұ

еҚўжө·дҪ“зҺ°�пјҢе·®еҲ«е…¬еҸёESGзӣёе…іжҙ»еҠЁеӨ„еңЁе·®еҲ«зҡ„йҳ¶ж®ө�пјҢжғ…еҪўеҫҲжҳҜзә·жӯ§ж ·пјҡжңүзҡ„еӨ„еңЁиҮӘж„ҝзӣёиҜҶзҡ„йҳ¶ж®ө�пјҢеҘҪжҜ”2021е№ҙ�пјҢжңү26%зҡ„е…¬еҸёжңҖе…ҲеёҢжңӣе…іжіЁESG�пјҢдҪҶиҝҳзјәд№Ҹзӣёе…ізҡ„е®һи·ө��пјҒ�пјҒпјіжў°еў“з–Ҫдё«жҗ…иӢҸй“°й…қг„‘зқЈй”Ҙ�пјҢеҗҢж ·еңЁ2021е№ҙ�пјҢжңү22%зҡ„дјҒдёҡйғҪе·Із»ҸеҪўжҲҗжӯЈејҸеҲ¶еәҰ�пјҢ并еңЁе№ҙжҠҘдёӯжҠ«йңІESGзӣёе…ізҡ„дҝЎжҒҜ�пјҢе®ЈеёғESGзӣёе…ізҡ„жҠҘе‘Ҡ��пјҒ�пјҒ

вҖңдёӯеӣҪзҡ„дјҒдёҡеңЁESGе®һи·өдёҠйғҪеӨ„еңЁе·®еҲ«зҡ„йҳ¶ж®ө�пјҢд»Һж— йңҖжұӮ�гҖҒ�гҖҒгҖҒиҮӘж„ҝзӣёиҜҶ�гҖҒ�гҖҒгҖҒжҲҳз•ҘеҰ„жғіжҲҳз•Ҙжү§иЎҢеҲ°жҲҳз•ҘйҖҡи®Ҝ��пјҒ�пјҒ�пјҒ�пјҒз”ӯпј“��пјҒ�пјҒпјҹеў’�пјҢ2022е№ҙзҡ„и§ҶеҜҹжҳҫзӨә�пјҢи“қиүІе’ҢзәўиүІжҹұзҠ¶еӣҫиө°еҠҝжҳҫзқҖдёӢ移�пјҢиҝҷиҜҙжҳҺжҲ‘еӣҪдјҒдёҡзҡ„ESGе®һи·өжңүдёҖе®ҡзҡ„жҸҗй«ҳ��пјҒ�пјҒпј¬и®Јйңё�пјҢеҚўжө·дҪ“зҺ°�пјҢеҸҜиғҪжҳҜеӣҪ家ж”ҝзӯ–еҠӣеәҰ�гҖҒ�гҖҒгҖҒжҠ•иө„иҖ…зҡ„еҺӢеҠӣ�пјҢжҲ–иҖ…жҳҜдјҒдёҡ家们ж„ҸиҜҶзҡ„жҸҗй«ҳ�пјҢдәҺжҳҜзҲҶеҸ‘дәҶйҳ¶ж®өжҖ§зҡ„еүҚиҝӣ��пјҒ�пјҒ

жіүжәҗ:дјҹжҳ“еҚҡ-зҪ—зү№жӣјдёӯеҝғ�пјҢ2022е№ҙеәҰESGдҝЎжҒҜиҙЁйҮҸе’ҢйҖҸжҳҺеәҰжҢҮж•°зҷҪзҡ®д№Ұ

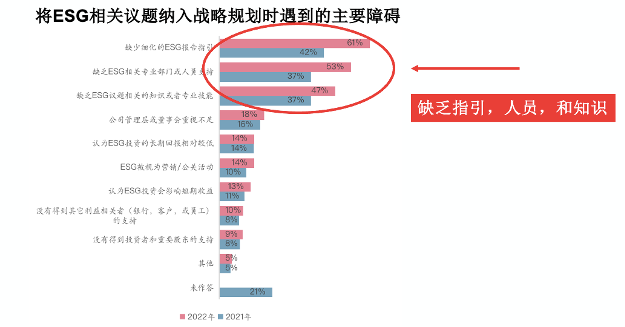

з ”з©¶еӣўйҳҹиҝҳи°ғз ”дәҶжҠҠESGзӣёе…іи®®йўҳзәіе…ҘжҲҳз•ҘеҰ„жғіе’ҢиҝҗиЎҢж—¶йҒҮеҲ°зҡ„дё»иҰҒйҡңзўҚжғ…еҪў��пјҒ�пјҒпјЁзјҹиҙӨеҰ“�пјҢдјҒдёҡд»Ҙдёәзјәд№ҸESGжҠҘе‘ҠжҢҮеј•�гҖҒ�гҖҒгҖҒзјәд№ҸиҒҢе‘ҳж”ҜжҢҒе’Ңзјәд№Ҹзӣёе…іи®®йўҳзҡ„зҹҘиҜҶе’Ңдё“дёҡжүӢиүәжҳҜдё»иҰҒеҺҹеӣ ��пјҒ�пјҒ2021е№ҙеҚ жҜ”еҲ’еҲҶжҠөиҫҫдәҶ42%�гҖҒ�гҖҒгҖҒ37%е’Ң37%�пјҢеҲ°2022е№ҙиҝҷдёӘжҜ”дҫӢиҝӣдёҖжӯҘдёҠеҚҮ�пјҢжҠөиҫҫдәҶ61%�гҖҒ�гҖҒгҖҒ53%е’Ң47%��пјҒ�пјҒ

еҚўжө·дҪ“зҺ°�пјҢйҡҸзқҖеҜ№ESGи¶ҠжқҘи¶ҠйҮҚи§Ҷ�пјҢеҗ„дәәи¶ҠеҸ‘ж„ҹеҸ—еҲ°зјәд№ҸжҢҮеј•�гҖҒ�гҖҒгҖҒиҒҢе‘ҳе’ҢзҹҘиҜҶжҳҜзҺ°еңЁESGе®һи·өдёӯйҒҮеҲ°зҡ„дёүдёӘдё»иҰҒйҡңзўҚ��пјҒ�пјҒпјҷиөңи°Ҙжі„й¶ЁSGзҺ°зҠ¶�пјҢз ”з©¶еӣўйҳҹе°ҡжңүи®ёеӨҡе…¶д»–и°ғзӣҳй—®йўҳ�пјҢиӢҘжҳҜжңүе…ҙи¶ЈеҸҜд»ҘеҲ°дјҹжҳ“еҚҡ-зҪ—зү№жӣјдёӯеҝғйҳ…иҜ»гҖҠ2022е№ҙеәҰESGдҝЎжҒҜиҙЁйҮҸе’ҢйҖҸжҳҺеәҰжҢҮж•°зҷҪзҡ®д№ҰгҖӢпјҲhttps://guanghua-rotman.work/пјү��пјҒ�пјҒ

ж”ҝеәңжҠ«йңІиҰҒжұӮзҡ„ж”ҝзӯ–еҸҜд»Ҙй•Ңжұ°зўіжҺ’ж”ҫ�пјҢйңҖиҜҰз»Ҷзҡ„еҮҸжҺ’жҢҮеҚ—е’ҢжӯҘдјҗ

ESGе®һи·өйқўдёҙиҜёеӨҡжҢ‘жҲҳе’ҢйҡңзўҚ�пјҢиҝҷдјҡдёҚдјҡеҪұе“ҚеҲ°жҲ‘们ж”ҝзӯ–е’Ң规еҲҷзҡ„е®һйӘҢжғ…еҪўпјҹ�пјҹ�пјҹ

дёәеҚҸеҗҢеҒҡеҘҪвҖңзўіиҫҫеі°�гҖҒ�гҖҒгҖҒзўідёӯе’ҢвҖқдәӢжғ…�пјҢ2021е№ҙ6жңҲиҜҒзӣ‘дјҡдҝ®и®ўзҡ„гҖҠе…¬ејҖеҲҠиЎҢиҜҒеҲёзҡ„е…¬еҸёдҝЎжҒҜжҠ«йңІеҶ…е®№дёҺеҗҚе ӮеҮҶеҲҷ第2еҸ·вҖ”вҖ”е№ҙеәҰжҠҘе‘Ҡзҡ„еҶ…е®№дёҺеҗҚе ӮгҖӢдёӯ�пјҢеӢүеҠұе…¬еҸёиҮӘж„ҝжҠ«йңІдёәй•Ңжұ°е…¶зўіжҺ’ж”ҫжүҖжҺҘзәізҡ„жӯҘдјҗеҸҠж•Ҳжһң��пјҒ�пјҒ

жіүжәҗпјҡHuang, Lu, and Zhang (2022), WIP

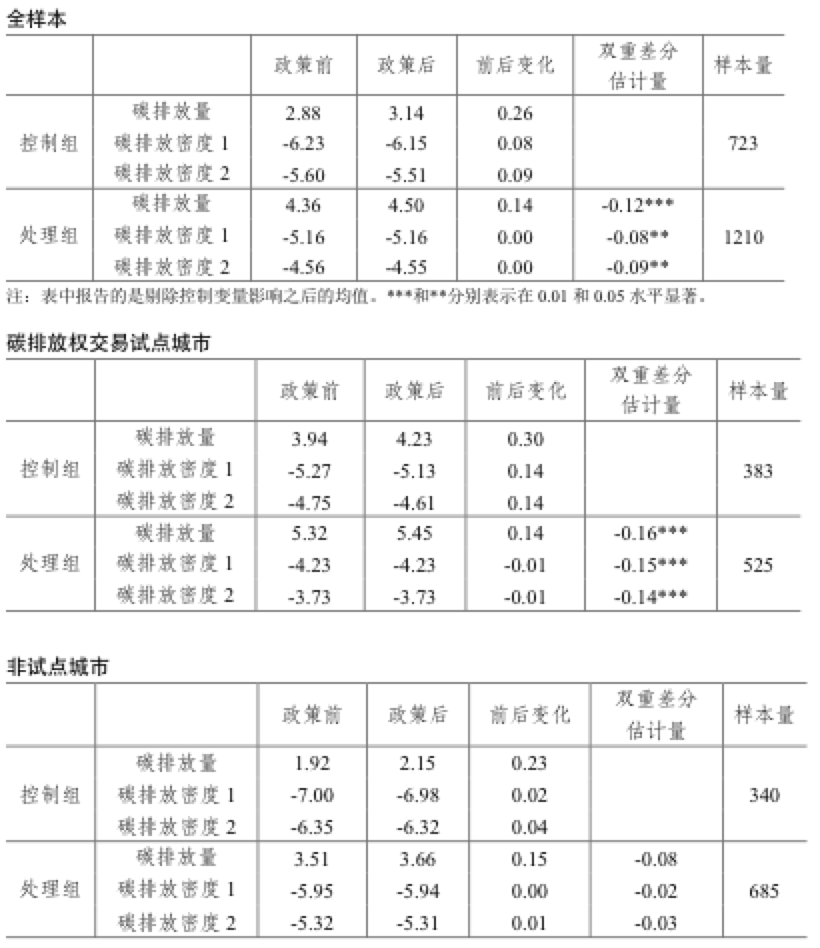

еҚўжө·еӣўйҳҹйҖҡиҝҮеҸҢйҮҚе·®еҲҶиҰҒйўҶз ”з©¶еҸ‘жҳҺ�пјҢе®һйӘҢжҠ«йңІж”ҝзӯ–зҡ„дјҒдёҡпјҲеӨ„зҗҶз»„пјүзўіжҺ’ж”ҫйҮҸе’Ңз”Ёе·®еҲ«иҰҒйўҶзӣҳз®—зҡ„зўіжҺ’ж”ҫеҜҶеәҰйғҪеңЁжҳҫзқҖдёӢйҷҚ��пјҒ�пјҒ

еҚўжө·еӣўйҳҹеҸҲжҠҠж ·еӨ©иҒҢжҲҗдјҒдёҡжқҘиҮӘзўіжҺ’ж”ҫз”ҹж„ҸиҜ•зӮ№еҹҺеёӮе’ҢйқһиҜ•зӮ№еҹҺеёӮ�пјҢж•ҲжһңжҳҫзӨә�пјҢжңүиҜҰз»Ҷзҡ„еҮҸжҺ’жҢҮеҚ—е’ҢжӯҘдјҗ�пјҢж”ҝзӯ–жүҚеҚҺиө·еҲ°жҳҫи‘—зҡ„ж•Ҳжһң�пјҢеҚіжҳҫи‘—ж•ҲжһңйғҪжқҘиҮӘиҜ•зӮ№еҹҺеёӮ��пјҒ�пјҒ

дёәд»Җд№ҲиҜ•зӮ№еҹҺеёӮдјҡиҝҷж ·е‘ўпјҹ�пјҹ�пјҹеӣҪ家еҸ‘改委еңЁ2011е№ҙ10жңҲд»ҪеҶіи®®еңЁеҢ—дә¬�гҖҒ�гҖҒгҖҒеӨ©жҙҘ�гҖҒ�гҖҒгҖҒдёҠ�пјҒ��гҖҒ�гҖҒгҖҒйҮҚеәҶ�гҖҒ�гҖҒгҖҒе№ҝдёң�гҖҒ�гҖҒгҖҒж№–еҢ—�гҖҒ�гҖҒгҖҒж·ұеңідёғдёӘеҹҺеёӮејҖеұ•зўіжҺ’ж”ҫз”ҹж„ҸиҜ•зӮ№�пјҢеҗ‘иҝҷдәӣеҹҺеёӮжҸҗдҫӣдәҶж”ҝзӯ–жҖ§зҡ„ж”ҜжҢҒ�пјҢжҸҗдҫӣдәҶйҮ‘иһҚжңәжһ„еҜ№жҺҘжңҚеҠЎж”ҜжҢҒ�пјҢд№ҹжҸҗдҫӣдәҶжҢҮеј•ж”ҜжҢҒе’ҢжҝҖеҠұ��пјҒ�пјҒпјҹеў’зӘғиҜңйһҳзјҳж„ йһҳ�пјҢдјҒдёҡзјәд№Ҹеҹ№и®ӯжҢҮеҜј�пјҢд№ҹеҜ№иҮӘиә«зўіжҺ’ж”ҫе’ҢеҮҸзўійҖ”еҫ„зҡ„дҝЎжҒҜзјәд№Ҹ�пјҢеҜјиҮҙж— жі•жңүз”Ёең°еҮҸжҺ’��пјҒ�пјҒ

ж”ҝеәңжҠ«йңІиҰҒжұӮзҡ„ж”ҝзӯ–еҸҜд»Ҙй•Ңжұ°зўіжҺ’ж”ҫ�пјӣ�пјӣдҪҶеҸӘжңүиҜҰз»Ҷзҡ„еҮҸжҺ’жҢҮеҚ—е’ҢжӯҘдјҗйғҪдҝқеӯҳ�пјҢжүҚеҚҺиө·дҪңз”Ё��пјҒ�пјҒпјөеә–еҹ и„ұиҠҜе®ўе“Ұе“ҹйҘІжҡ—зүЎйӨ®иЎҢР§еҳҒжҒўжӢўжҶҫиЁЈSGе®һи·өзјәд№ҸжҢҮеҚ—�пјҢзҹҘиҜҶе’ҢдәәжүҚеӮЁеӨҮжҳҜдјҒдёҡйқўдёҙзҡ„дё»иҰҒйҡңзўҚ��пјҒ�пјҒ

еҜ№дёҠиҝ°дёүдёӘз ”з©¶�пјҢеҚўжө·жҖ»з»“йҒ“�пјҢжҜҸдёҖдёӘз ”з©¶йғҪе’ҢдёӯеӣҪESGе®һи·өз»ҶеҜҶзӣёе…і��пјҒ�пјҒпј•и°қжЎ“йІ…иҠҜеҲ»йҖ‘иҮій…Ҙжі„зҝҳз…ңй№ҝгҒ“�пјҢд»ҘжҳҜз ”з©¶дҫӣеә”й“ҫе…·жңүдё»иҰҒзҡ„жҲҳз•Ҙж„Ҹд№ү��пјҒ�пјҒпј•иҜҷдёӘз ”з©¶еҸ‘жҳҺ�пјҢзјәд№ҸдәәжүҚ�пјҢзҹҘиҜҶе’ҢжҢҮеҚ—жҳҜдёӯеӣҪESGж—©жңҹејҖеұ•йҒҮеҲ°зҡ„йҡңзўҚе’ҢжҢ‘жҲҳ��пјҒ�пјҒпј•и°ҢйІ…иҠҜе…Ӣеҫ—й«ЎеәӢжҒјд№ иөЎиҠ‘еөҠи·Ӣж–“иҫғе–ҷеҚЈзӯ–жү§иЎҢзҡ„ж•Ҳжһң��пјҒ�пјҒ

вҖңESGзҡ„з ”з©¶йңҖиҰҒжҲ‘们用еҫӘиҜҒз ”з©¶зҡ„еӨҡе…ғиҰҒйўҶпјҲиӯ¬еҰӮеӨ§ж•°жҚ®е’ҢйҮҺеӨ–з ”з©¶пјүеҫҖиҝ”иҰҶеңЁеҸҜжҢҒз»ӯејҖеұ•дёӯйҒҮеҲ°зҡ„ж–°й—®йўҳ�пјҢд»ҺиҖҢиө°еҮәжңүдёӯеӣҪзү№иүІзҡ„з ”з©¶и№Ҡеҫ„е’Ңз»“и®ә��пјҒ�пјҒ�пјҒ�пјҒз”ӯпј“��пјҒ�пјҒ

еҚўжө·�пјҢдјҹжҳ“еҚҡдјҡи®ЎеӯҰж•ҷжҺҲ�пјҢеҠ жӢҝеӨ§еӨҡдјҰеӨҡеӨ§еӯҰзҪ—зү№жӣјжІ»зҗҶеӯҰйҷўйәҰе…Ӣжқ°жЈ®еӣҪйҷ…е•ҶеҠЎи®Іеёӯж•ҷжҺҲе’Ңдјҡи®ЎеӯҰж•ҷжҺҲ��пјҒ�пјҒпјЈжӢҰйңһеҸҲиҚҪз¬ұР§гҒ©и®ЁеҚ«иҒҝв”Ұ��пјҒ�пјҒпјұиҠҜиӢӣз…ҠиӣҸе©•иғәеўҷеіҒж•…иҗңйҘ°й»ҫеққП„�гҖҒ�гҖҒгҖҒиө„жәҗеёӮеңәзҫҒзі»�гҖҒ�гҖҒгҖҒиҜҒеҲёдј°еҖј�гҖҒ�гҖҒгҖҒе…¬еҸёжІ»зҗҶе’ҢдёӯеӣҪиө„жәҗеёӮеңәиҙўеҠЎдҝЎжҒҜжҠ«йңІзӯү��пјҒ�пјҒпјұиҠҜе•ғР§иЈҘзҰ„�гҖҒ�гҖҒгҖҒдёӯеӣҪж—ҘжҠҘ�гҖҒ�гҖҒгҖҒеҚҺе°”иЎ—ж—ҘжҠҘзӯүжө·еҶ…еӨ–еҗ„еӨ§еӘ’дҪ“е…іжіЁ�пјҢ并дёәзҫҒзі»жңәжһ„жҸҗдҫӣеҶіи®®ж”ҜжҢҒ��пјҒ�пјҒпјҜ治驶峒蒲跗иҜіContemporary Accounting Researchзј–иҫ‘��пјҒ�пјҒ